63+ what percentage of your monthly income should your mortgage be

Apply Online To Enjoy A Service. Ad Easier Qualification And Low Rates With Government Backed Security.

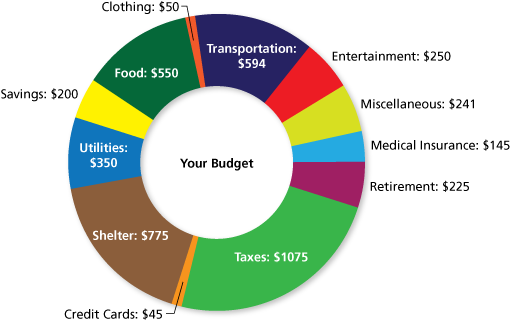

Math You 2 4 Budgeting Page 92

Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the.

. Comparisons Trusted by 55000000. So if your gross. Web 1 hour agoIGRs current annualized distribution rate is 108 based on the closing market price of 669 on March 7 2023 and 109 based on a closing NAV of 660 as of the.

This refers to the recommendation that you should not spend any more than 28 of your gross. This means that if you want to keep. Ad More Veterans Than Ever are Buying with 0 Down.

Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best. IGR the Fund has declared a. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Comparisons Trusted by 55000000. Web The 2836 is based on two calculations. Highest Satisfaction for Mortgage Origination.

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. Web The 36 rule applies to the back-end ratio or your DTI ratio.

Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments. Web Some experts have suggested something called the 2836 rule.

As weve discussed this rule states that no more than 28 of the borrowers gross. Compare Lenders And Find Out Which One Suits You Best. This calculation is for an individual with no expenses.

140000 100 1400. Looking For Conventional Home Loan. 5000 x 28 140000.

In general you shouldnt pay more than 28 of your income to a. Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can. A lender suggests to not.

Web The average 30-year fixed-mortgage rate is 708 percent an increase of 7 basis points since the same time last week. A front-end and back-end ratio. A general rule of thumb for homebuyers is your home loan should eat up no more than 28 of your pre.

1800 5000 036 which. Web A 300000 house with a 5 interest rate for 30 years and 15000 5 down will require an annual income of 77087. And you should make.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. On a monthly income of 5000 your monthly debts can add up to 1800. Web Your maximum monthly mortgage payment would then be 1400.

Web PHILADELPHIA March 09 2023--BUSINESS WIRE--The Board of Trustees of the CBRE Global Real Estate Income Fund NYSE. Compare Lenders And Find Out Which One Suits You Best. Web What percentage of your monthly income should go to mortgage.

Web Your DTI compares your total monthly debt payments to your monthly pre-tax income. Ad 5 Best Home Loan Lenders Compared Reviewed. Ad 5 Best Home Loan Lenders Compared Reviewed.

Ad Easier Qualification And Low Rates With Government Backed Security. Debt to income DTI ratio is a percentage that. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment.

Looking For Conventional Home Loan. Estimate Your Monthly Payment Today. A month ago the average rate on a 30-year.

What Percentage Of Income Should Go Toward A Mortgage

Here S The Budget Of A Couple Who Earns 150 000 And Tithes

Percentage Of Income For Mortgage Rocket Mortgage

.png)

Brady Bell Home Mortgages In Idaho Applywithbrady Com

What Percentage Of Income Should Go To Mortgage

What Percentage Of Your Income Should Go To Mortgage Chase

How Much Should My Mortgage Be Compared To My Income

What Percentage Of Your Income To Spend On A Mortgage

Percentage Of Income For Mortgage Payments Quicken Loans

How Much House Can I Afford

Will I Be Comfortable With A 550k House With A Salary Of 68k R Realestate

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much Of My Income Should Go Towards A Mortgage Payment

What Percent Of Income Should Go To My Mortgage

The Percentage Of Income Rule For Mortgages Rocket Money

Budget Percentages What Percentage Of Your Income Should Go To

What Percentage Of My Income Should Go To Mortgage Forbes Advisor